Why Reviewing and Fixing Your Transactions Based on the Audit Results Matters

Crypto is no longer a gray area, especially in countries like the United States and the United Kingdom. Every transaction—whether buying, selling, swapping, or spending—can trigger a taxable event. Misreporting your crypto activity could lead to penalties, back taxes, or even an audit.

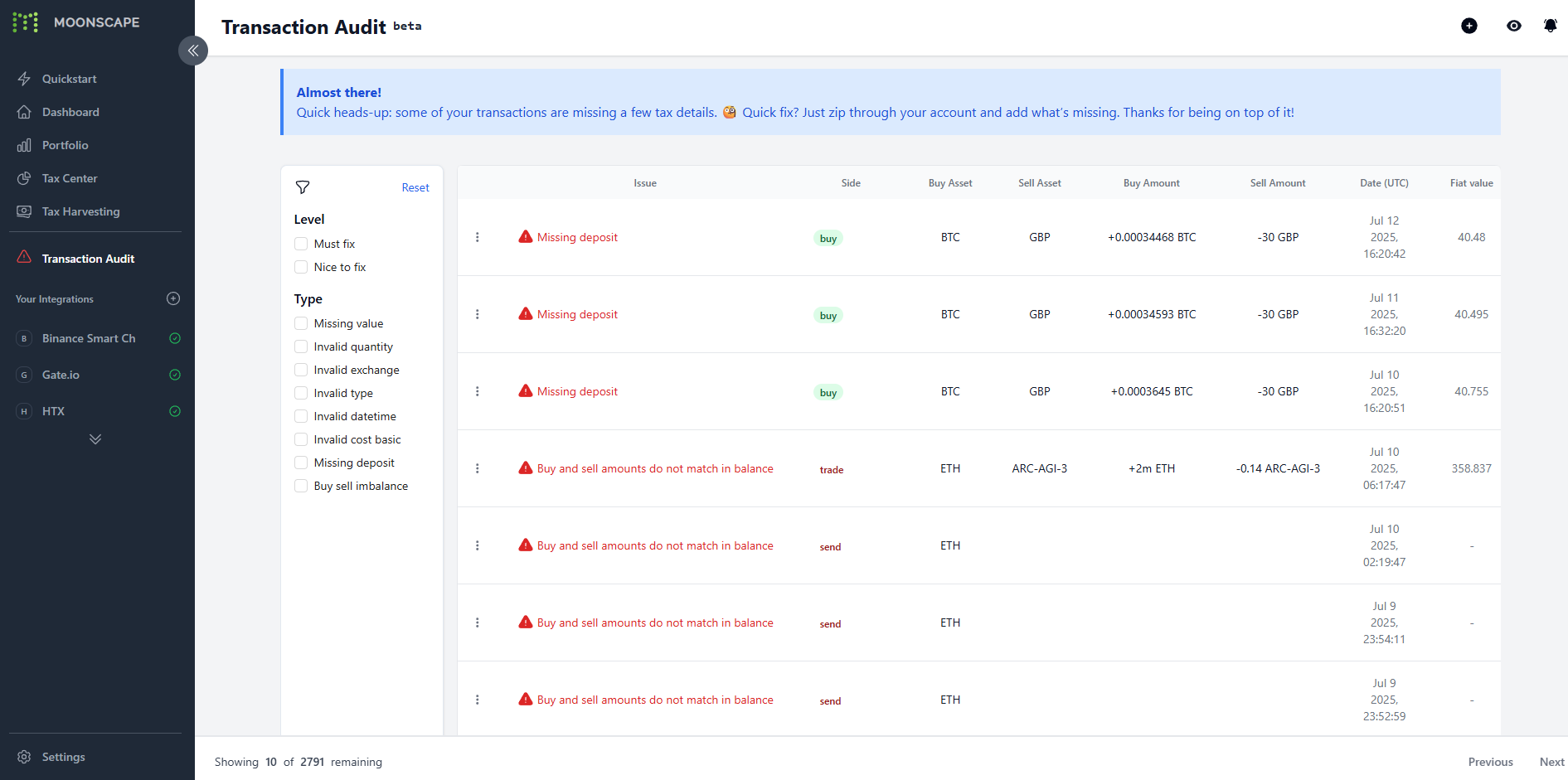

That’s why accurate reporting is critical. Moonscape audits all your crypto transactions across wallets, exchanges, and blockchains. It flags issues like missing trades, incorrect cost basis, unaccounted fees, and misclassified holding periods.

Instead of manually combing through hundreds of entries, you can rely on Moonscape audit results to pinpoint what needs fixing and why.

Once you import your wallet and exchange data, Moonscape provides a detailed audit report. This guide will walk you through:

- How to read and interpret your audit results

- How to identify and correct inaccurate transactions

Key Fields in a Moonscape Transaction

-

Exchange (Required)

🏦 The exchange, wallet, or blockchain where the transaction occurred (e.g., Binance, Coinbase, MetaMask).

Why it matters: Helps identify the transaction source and verify its legitimacy. -

Datetime (Required)

⏱ The exact date and time the transaction occurred (in ISO format or UTC).

Why it matters: Crucial for determining your holding period (short-term vs. long-term). -

Type (Required)

🔁 The transaction type—trade, swap, transfer, airdrop, staking reward, etc.

Why it matters: Dictates how the transaction is taxed. -

Buy Amount (Required)

📈 The asset you received (e.g., ETH, USDT).

Why it matters: Represents what you acquired, which affects gain or loss calculation. -

Sell Amount (Required)

📦 The asset you gave up in the transaction.

Why it matters: Used to calculate your cost basis and capital gains. -

Fiat Value (Required)

💸 The fiat value of the transaction at the time it occurred (USD, EUR, GBP, etc.).

- If it's a buy: Represents the cost basis—the amount you paid.

- If it's a sell: Reflects the proceeds you received.

Why it matters: Central to calculating capital gains or losses.

- Fees Value (Optional)

💸 Any network (gas), trading, or platform fees shown in fiat currency.

Why it matters: Deductible from proceeds or added to cost basis for accurate tax calculations.

How to Edit a Transaction in Moonscape

There are two ways to edit a transaction in Moonscape:

- Click on the transaction row, then click the “Edit” button.

- Click the “More” icon at the end of the row, then select “Edit” from the dropdown.

Common Audit Error Types in Moonscape

🔴 Must Fix

These errors must be resolved to ensure accurate profit and loss, tax, and portfolio calculations. If they can’t be corrected, consider deleting or ignoring the transaction.

1. Missing Value

A required field is empty (e.g., asset, quantity, datetime).

How to fix: Retrieve the value from your exchange or wallet. If unknown, delete or ignore the transaction.

2. Invalid Quantity

Negative, zero (where not allowed), or non-numeric quantity values.

How to fix: Use a valid, positive number.

3. Invalid Exchange

Unrecognized exchange or wallet name (e.g., “Bnance” instead of “Binance”).

How to fix: Correct it to a supported name. Use Moonscape dropdown suggestions to avoid typos.

4. Invalid Type

Unsupported or misspelled transaction type.

How to fix: Use valid types like buy, sell, swap, airdrop, etc.

5. Invalid Datetime

Datetime is missing or in an invalid format (e.g., “tomorrow” or “13-25-2022”).

How to fix: Use a valid ISO 8601 format (e.g., 2023-01-15T14:00:00Z).

6. Invalid Cost Basis

Missing, negative, or non-numeric fiat value for cost basis.

How to fix: Estimate it using the asset’s market value at the time. If truly unknown, mark the transaction as non-taxable or delete it.

🟡 Nice to Fix

These errors won’t break the tax engine but may lead to imprecise results.

7. Missing Deposit

A withdrawal or trade sell doesn’t have a matching deposit elsewhere.

How to fix: Check if the receiving transaction is missing. If the asset was spent or sent externally, mark it accordingly.

8. Buy-Sell Imbalance

You sold more of an asset than you bought.

How to fix: Add missing buy transactions or correct amounts to reconcile totals.

Final Tip

Moonscape audit helps simplify cleanup, catch errors early, and keep your records tax-ready. Regularly reviewing flagged issues ensures your portfolio and tax reports are as accurate as possible.